R K SWAMY Limited IPO is a MAIN BOARD IPO. They are going to raise ₹423.56 Crores via IPO. The issue is priced at ₹270 to ₹288 per equity share. The IPO is to be listed on NSE, BSE

R K SWAMY Limited IPO opens for subscription on March 04, 2024, and closes on March 06, 2024. The allotment for the R K SWAMY Limited IPO is expected to be finalized on March 07, 2024. R K SWAMY Limited IPO will list on BSE, NSE with tentative listing date fixed as 12 March 2024.

| IPO Details | Allotment |

| Minimum Investment ₹14,400 / 1– Lot (50 shares) | Price Range ₹270-₹288 | |

| Max Quantity 13-Lots/ (650 Shares) | Max Investment ₹187,200 | Retail Discount ₹0 |

| Investor category and sub category Individual- HNI & Retail | Issue Size 423.56 Cr | Employee Discount ₹27 per share |

| Total Issue Size 14,706,944 Shares (Aggregating up to ₹423.56 Cr) | Share Holding Pree Issue 44,457,140 | Issue Type Book build Issue IPO |

| Fresh Issue Share 6,006,944 Shares (Aggregating up to ₹173.00 Cr) | Share Holding Post Issue 50,464,084 | Listing At BSE, NSE |

| Offer For Sale 8,700,000 Shares of ₹5 (Aggregating up to ₹250.56 Cr) | Face value ₹5 |

IPO Dates

| Offer Starts | 04 March 2024 |

| Offer Ends | 06 March 2024 |

| Allotment | 07 March 2024 |

| Refunds | 11 March 2024 |

| Credit of shares to Demat account | 11 March 2024 |

| IPO Listing | 12 March 2024 |

About R K SWAMY Limited

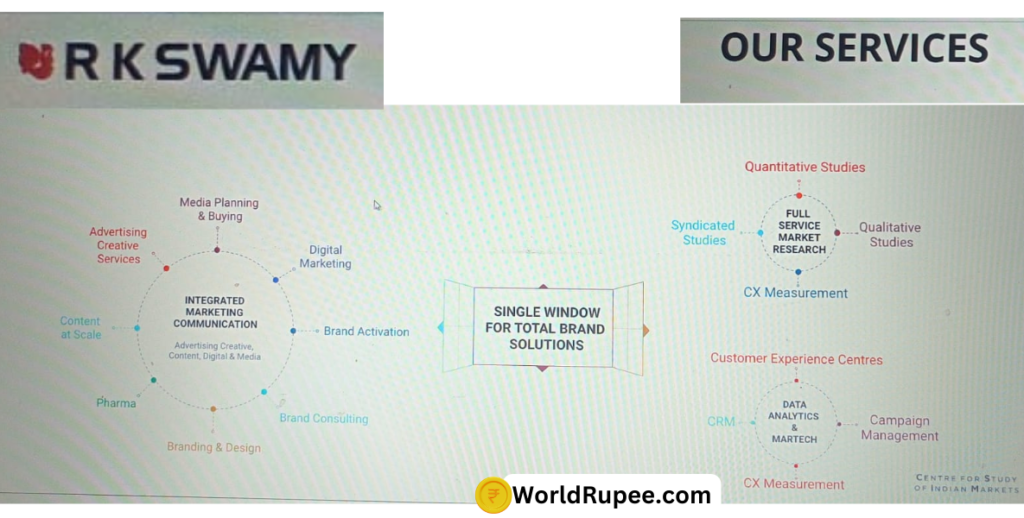

Founded in 1973, R K Swamy Limited is engaged in the business of integrated marketing communications, customer data analysis, full-service market research and syndicated studies.

R K SWAMY is the largest Indian majority-owned integrated marketing services provider in India, offering a single window solution for creative, media, data analytics, and market research services.

The company’s numerous clients include Aditya Birla Sun Life AMC Limited, Cera Sanitaryware Limited, Dr. Reddy’s Laboratories Limited, E.I.D. – Parry (India) Limited, Fujitsu General (India) Private Limited, Gemini Edibles and Fats India Limited, Havells India Limited, Hawkins Cookers Limited, Himalaya Wellness Company, Hindustan Petroleum Corporation Limited, ICICI Prudential Life Insurance Company Limited, IFB Industries Limited, Mahindra and Mahindra Limited, Oil and Natural Gas Corporation Limited, Royal Enfield (a unit of Eicher Motors), Shriram Finance Limited, Tata Play Limited, Ultratech Cement Limited, and Union Bank of India.

They are a data-driven integrated marketing services provider and all segments of their business use digital initiatives extensively. During Fiscal 2023, they released over 818 creative campaigns on behalf of their clients across various media outlets, handled over 97.69 terabytes of data, and conducted over 2.37 million consumer interviews across quantitative, qualitative, and telephonic surveys. They aim to provide the highest levels of professional service to meet the continuous needs of their clients and aim to continue growing their capabilities with an unyielding focus on the needs of their clients.

| Founded in | Managing Director |

| 1973 | Mr. |

R K SWAMY Limited IPO Prospectus

| . | |

| DRHP Draft Prospectus | Click Here |

| RHP Draft Prospectus | Click Here |

R K SWAMY Limited IPO Lot Size

R K SWAMY Limited IPO minimum market lot is 50 shares with ₹14,400 application amount. The retail investors can apply up-to 13 lots with 650 shares or ₹187,200 amount.

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 50 | ₹14,400 |

| Retail (Max) | 13 | 650 | ₹187,200 |

| S-HNI (Min) | 14 | 700 | ₹201,600 |

| S-HNI (Max) | 69 | 3,450 | ₹993,600 |

| B-HNI (Min) | 70 | 3,500 | ₹1,008,000 |

Share Holding

| Share Holding Pre-Issue | 83.03% |

| Share Holding Post-Issue |

Financials

| Year | 2023 | 2022 | 2021 |

| Revenue | ₹299.91 | ₹244.97 | ₹183.22 |

| Assets | ₹313.65 | ₹406.44 | ₹390.06 |

| Profit | ₹31.26 | ₹19.26 | ₹3.08 |

| All values are in Rs. Cr |

Fundamentals

| Values | Values | ||

| Market cap | 1453.37 Cr | ROE | 16.47% |

| P/E (X) | ROCE | 6.29% | |

| POST P/E (X) | EPS | 7.03 | |

| Debt to Equity | 1.5 | RONW | 5.41% |

Objects of the Issue

- Funding working capital requirements of our Company.

- Funding capital expenditure to be incurred by the Company for setting up a digital video content production studio (“DVCP Studio”).

- Funding investment in IT infrastructure development of the company, and the Material Subsidiaries, Hansa Research and Hansa Customer Equity.

- Funding setting up of new customer experience centres (“CEC”) and computer aided telephonic interview centres (“CATI”) of the company.

- General corporate purposes

Brokerage Firm IPO Review

- To be updated soon

| R K SWAMY Limited Contact Details | |

| Address | R K SWAMY Limited No. 19, Wheatcrofts Road, Nungambakkam Chennai-600 034, |

| Phone | +91 22 4057 6499 |

| secretarial@rkswamy.com | |

| Website | https://www.rkswamy.com/ |

| R K SWAMY Limited IPO Lead Managers |

| SBI Capital Markets Limited Iifl Securities Ltd Motilal Oswal Investment Advisors Limited |

| R K SWAMY Limited IPO Registrar | |

| . | Kfin Technologies Limited |

| Phone | 04067162222, 04079611000 |

| rkswamy.ipo@motilaloswal.com | |

| Website | https://kosmic.kfintech.com/ipostatus/ |

| R K SWAMY Limited IPO Allotment Status Check |

| IPO Allotment Status Check Click Here |

R K SWAMY Limited IPO FAQs

What is R K SWAMY Limited IPO?

- R K SWAMY Limited IPO is a MAIN BOARD IPO. They are going to raise ₹423.56 Crores via IPO. The issue is priced at ₹270 to ₹288 per equity share. The IPO is to be listed on NSE, BSE

When R K SWAMY Limited IPO will open?

- The IPO is to open on March 04, 2024, for QIB, NII, and Retail Investors.

What is R K SWAMY Limited IPO Investors Portion?

- The investors’ portion for QIB is 75%, NII is 15%, and Retail is 10%.

What is R K SWAMY Limited IPO Size?

- R K SWAMY Limited IPO size is ₹423.56 crores.

What is R K SWAMY Limited IPO Price Band?

- R K SWAMY Limited IPO Price Band is ₹270 To ₹288 per equity share.

What is R K SWAMY Limited IPO Minimum and Maximum Lot Size?

- The IPO bid is Minimum 1-Lot (50 Shares) with ₹14,400. and Maximum Lot Size 13-Lots (650 Shares) with ₹187,200

What is R K SWAMY Limited IPO Allotment Date?

- R K SWAMY Limited IPO allotment date is March 07, 2024.

What is R K SWAMY Limited IPO Listing Date?

- R K SWAMY Limited IPO listing date is March 12, 2024. The IPO to list on NSE, BSE.