Sai Swami Metals & Alloys Limited IPO is an BSE SME IPO. They are going to raise ₹15.00 Crores via IPO. The issue is priced at ₹60 to ₹60 per equity share. The IPO is to be listed on BSE.

Sai Swami Metals & Alloys Limited IPO opens for subscription on April 30, 2024, and closes on May 03, 2024. The allotment for the Sai Swami Metals & Alloys Limited IPO is expected to be finalized on May 06, 2024. Sai Swami Metals & Alloys Limited IPO will list on BSE SME with tentative listing date fixed as May 08, 2024.

| IPO Details | allotment |

| Minimum Investment ₹120,000 /1 Lot (2000 shares) | Price Range ₹60-₹60 | |

| Max Quantity 1 Lots/2000 Shares | Max Investment ₹120,000 | Retail Discount ₹0 |

| Investor category and subcategory Individual- HNI & Retail | Issue Size 15.00 Cr | Employee Discount ₹0 |

| Total Issue Size 2,500,000 Shares (aggregating up to ₹15.00 Cr) | Share Holding Pree Issue 4,117,710 | Issue Type Fixed Price Issue IPO |

| Fresh Issue Share 2,500,000 Shares (aggregating up to ₹15.00 Cr) | Share Holding Post Issue 6,617,710 | Listing At BSE SME |

| Market Maker Portion 128,000 Shares (Sunflower Broking) | Face value ₹10 pr share. |

IPO Dates

| Offer Starts | 30 April 2024 |

| Offer Ends | 03 May 2024 |

| Allotment | 06 May 2024 |

| Refunds | 07 May 2024 |

| Credit of shares to Demat account | 07 May 2024 |

| IPO Listing | 08 May 2024 |

About Sai Swami Metals & Alloys Limited

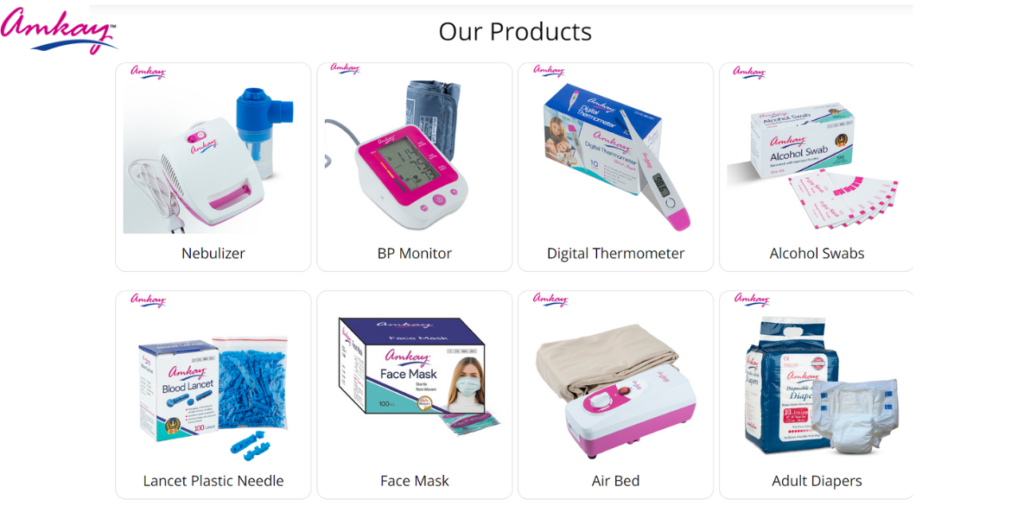

Incorporated in September, 2022,Sai Swami Metals and Alloys Pvt. Ltd. trades in a wide range of stainless steel products to cater to the varied needs of our customers.

The company’s product line includes a variety of kitchenware such as Dinner Sets, S.S. Casseroles, S.S. Multi Kadai, S.S. Water Bottles, Stainless Steel Sheets, Stainless Steel Circles, and various utensils.

The Dolphin brand is recognized for trading and marketing stainless steel kitchenware products by the company and its two subsidiaries, Bhagat Marketing Private Limited and Dhruvish Metals LLP.

| Incorporated in | Managing Director |

| 2022 | Mr. |

Share Holding

The promoter of the company is Mr. Nipun Anantlal Bhaga.

| Share Holding Pre-Issue | 99.88% |

| Share Holding Post-Issue | 62.15% |

Sai Swami Metals & Alloys Limited IPO Prospectus

| Sai Swami Metals & Alloys Limited IPO Prospectus | |

| DRHP Draft Prospectus | Click Here |

| RHP Draft Prospectus | Click Here |

Financials

| Year | 2023 | 2022 | 2021 |

| Revenue | ₹626.76 | ₹ | ₹ |

| Assets | ₹2,583.16 | ₹ | ₹ |

| Profit | ₹3.83 | ₹ | ₹ |

| values are in ₹. Lakhs |

Fundamentals

Company’s key performance indicators

| Values | Values | ||

| Market cap | Cr | ROE | % |

| P/E (X) | 11.34 | ROCE | % |

| POST P/E (X) | 16.58 | EPS | 5.29 |

| Debt to Equity | RONW | 27.02% |

Objects of the Issue

The Objects of the company is to raise funds for:

- To Meet Incremental Working Capital Requirements

- To Invest in Subsidiary Company

- To Purchase of Machineries

- General Corporate Purpose

Brokerage Firm IPO Review

- To be updated soon

| Sai Swami Metals & Alloys Limited Contact Details | |

| Address | Sai Swami Metals & Alloys Limited 05, Harekrishana Industrial Estate Bakrol, Ahmedabad, Daskroi-382430 |

| Phone: | +91 99099 70863 |

| cs@saiswamimetals.com | |

| Website | https://www.saiswamimetals.com/ |

| Sai Swami Metals & Alloys Limited IPO Registrar | |

| . | Bigshare Services Pvt Ltd |

| Phone | +91-22-6263 8200 |

| ipo@bigshareonline.com | |

| Website | http://www.bigshareonline.com |

| Sai Swami Metals & Alloys Limited IPO Allotment Status Check |

| Sai Swami Metals & Alloys Limited IPO Allotment Status Check Click Here |

| Sai Swami Metals & Alloys Limited Lead Managers | |

| Swastika Investmart Ltd 305, Madhuban Building, Cochin Street, S.B.S Road, Mumbai, Maharashtra- 400001 | |

| Phone | +91-22-22655565 |

| merchantbanking@swastika.co.in | |

| Website | http://www.swastika.co.in |

Sai Swami Metals & Alloys Limited IPO FAQs

What is Sai Swami Metals & Alloys Limited IPO?

- Sai Swami Metals & Alloys Limited IPO is an BSE SME IPO. They are going to raise ₹15.00 Crores via IPO. The issue is priced at ₹60 to ₹60 per equity share. The IPO is to be listed on BSE.

- The IPO opens on April 30, 2024, and closes on May 03, 2024.

When Sai Swami Metals & Alloys Limited IPO will open?

- The IPO is to open on April 30, 2024, for NII, and Retail Investors. and closes on May 03, 2024

What is Sai Swami Metals & Alloys Limited IPO Investors Portion?

- The investors’ portion for NII is 50%, and Retail is 50%.

What is Sai Swami Metals & Alloys Limited IPO Size?

- Sai Swami Metals & Alloys Limited IPO size is ₹15.00 crores.

What is Sai Swami Metals & Alloys Limited IPO Price Band?

- Sai Swami Metals & Alloys Limited IPO Price Band is ₹60 to ₹60 per equity share.

What is Sai Swami Metals & Alloys Limited IPO Minimum and Maximum Lot Size?

- The IPO bid is Minimum 1 Lot (2000 Shares) with ₹120,000. and Maximum Lot Size 1 Lots (2000 Shares) with ₹120,000

What is Sai Swami Metals & Alloys Limited IPO Allotment Date?

- Sai Swami Metals & Alloys Limited IPO allotment date is May 06, 2024.

What is Sai Swami Metals & Alloys Limited IPO Listing Date?

- Sai Swami Metals & Alloys Limited IPO listing date is May 08, 2024. The IPO to list on BSE.