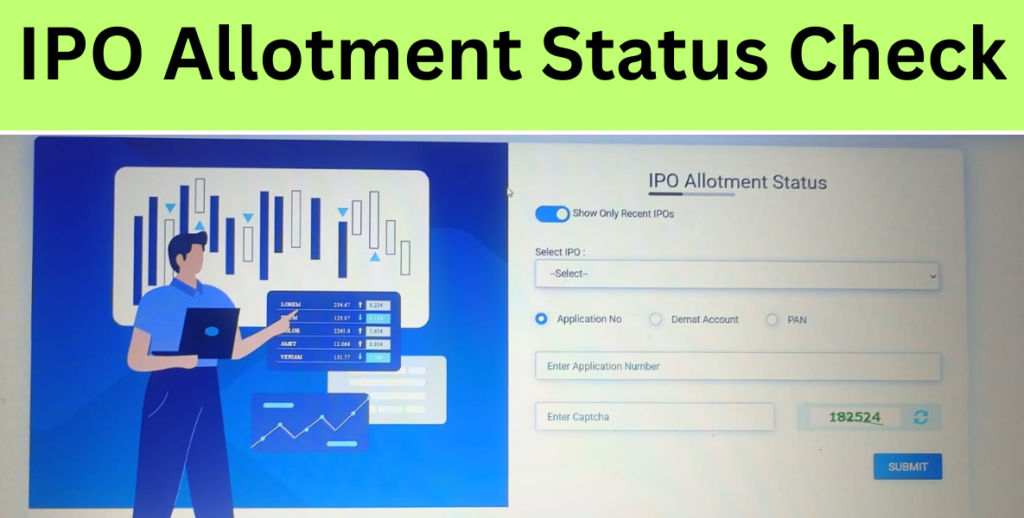

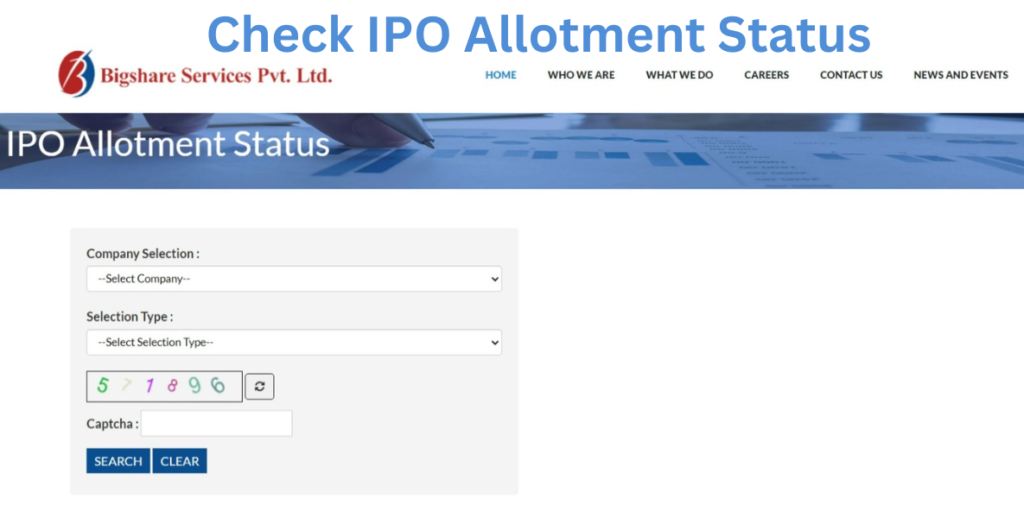

Step 1: How to Popular Vehicles & Services Limited IPO Allotment Status on Online?

Popular Vehicles & Services Limited IPO allotment is expected on March 15, 2024.

Popular Vehicles & Services Limited IPO Allotment Status is to be finalized March 15, 2024. The refund will be initiated on 18 March 2024. and the shares will be credited to the Demat account on 18 March 2024. Popular Vehicles & Services Limited IPO to list on March 19, 2024. The IPO investors can check their Popular Vehicles & Services Limited IPO allotment status online on the ‘Link Intime India Private Ltd‘ website or they can check it via their bank account and Demat login as offline mode. Check out here step to step guide from where you can check Popular Vehicles & Services Limited IPO allotment status online.

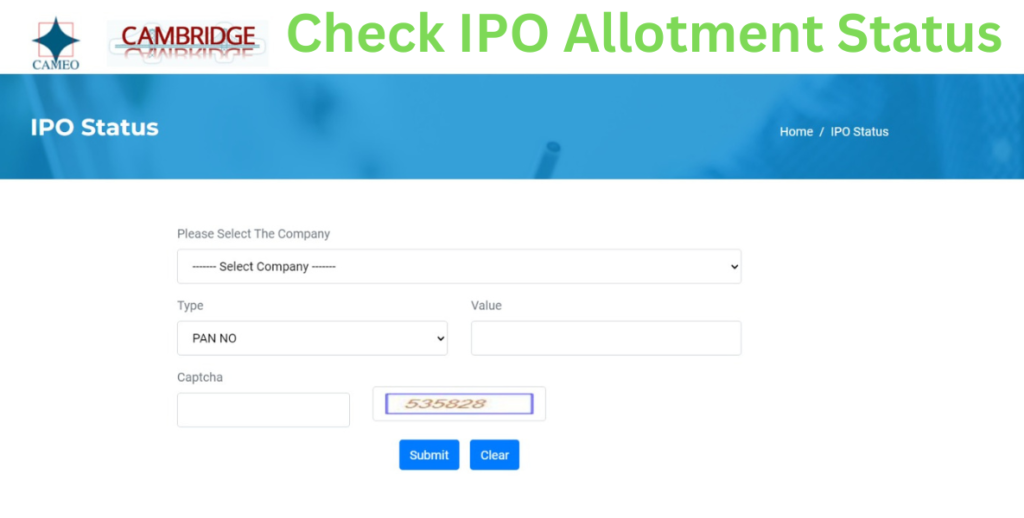

To check Popular Vehicles & Services Limited IPO allotment status, follow the steps below:

- Click on the below allotment status check button.

- Select Company Name ‘Popular Vehicles & Services Limited’

- Enter your PAN Number, Application Number or DP Client ID (Anyone).

- Click on ‘Search‘ Button

- You will be able to see your ‘Popular Vehicles & Services Limited‘ IPO allotment status on the screen (mobile/desktop).

On securing the allotment, you will receive the credit of equivalent shares in your Demat account.

If you have any concerns or queries about the allotment status, contact Link Intime India Private Ltd either by phone or email. Investors can call on +91-22-4918 6270 or send an email with all relevant details to popularvehicles.ipo@linkintime.co.in

Step 2: How to check Popular Vehicles & Services Limited IPO Allotment Status in Demant Account?

- Call Your Broker or Login to Your Demat Account / Trading Account

- Check whether the stock is credited to your account or not.

- If you got the allotment the credited shares will appear in the Demat account

Step 3: How to Popular Vehicles & Services Limited IPO Allotment Status in Bank Account?

- Login to your Bank Account from which you applied the Popular Vehicles & Services Limited IPO

- Check the Balance Tab

- If you got the allotment the Amount will be debited

- If you did not get the allotment the Amount will be released

- If you got the allotment, you got an SMS “Dear Customer, Bank Name Account 00001 is debited with INR 00000.00 on Date. Info: IPO Name. The Available Balance is INR 000000.”

Popular Vehicles & Services Limited IPO Allotment Status FAQs

When is Popular Vehicles & Services Limited IPO Allotment Date?

Popular Vehicles & Services Limited IPO Allotment is to be available on March 15, 2024.

What will be Popular Vehicles & Services Limited IPO Refund Date?

The IPO refund date is March 18, 2024

How to check the Popular Vehicles & Services Limited IPO Allotment Status?

- Visit the Popular Vehicles & Services Limited IPO allotment status page.

- Click on the green Popular Vehicles & Services Limited IPO Allotment Status.

- Enter either PAN number, Application Number or DP Client ID of the demat account to check the Popular Vehicles & Services Limited IPO allotment status.

- Click Search.

The allotment result looks like as below:

- PAN No.: NMMLK19157J

- Application No.: PN061214606107

- Name: Mr. Ravi Singh

- Shares Applied: 50

- Shares Allotted: 50

Where to check Popular Vehicles & Services Limited IPO allotment status?

Popular Vehicles & Services Limited IPO allotment status is expected on March 15, 2024. Click the green button Popular Vehicles & Services Limited IPO Allotment Status above to check the allotment.

When will Popular Vehicles & Services Limited get list?

The Popular Vehicles & Services Limited IPO is planned to list the shares on March 19, 2024, at NSE & BSE

Why I didn’t get allotment in Popular Vehicles & Services Limited IPO?

The reason you didn’t get the Popular Vehicles & Services Limited IPO could be:

- IPO become oversubscribed and allotment process is completed through a lottery

- The IPO application got rejected due to mismatch/incomplete information

- The issue price is higher than the bid price. (Always apply on cut-off price).