Aadhar Housing Finance Limited IPO is a MAIN BOARD IPO. They are going to raise ₹3,000.00 Crores via IPO. The issue is priced at ₹300 to ₹315 per equity share. The IPO is to be listed on NSE, BSE

Aadhar Housing Finance Limited IPO opens for subscription on May 08, 2024. and closes on May 10, 2024. The allotment for the Aadhar Housing Finance Limited IPO is expected to be finalized on May 13, 2024. Aadhar Housing Finance Limited IPO will list on BSE, NSE with tentative listing date fixed as 15 May 2024.

| IPO Details | Allotment |

| Minimum Investment ₹14,805 / 1– Lot (47 shares) | Price Range ₹300-₹315 | |

| Max Quantity 13-Lots/ (611 Shares) | Max Investment ₹192,465 | Retail Discount ₹0 |

| Investor category and sub category Individual- HNI & Retail | Issue Size 3,000 Cr | Employee Discount ₹23 |

| Total Issue Size 95,238,095 Shares (Aggregating up to ₹3,000.00 Cr) | Share Holding Pree Issue 394,754,970 | Issue Type Book build Issue IPO |

| Fresh Issue Share 31,746,032 Shares (Aggregating up to ₹1,000.00 Cr) | Share Holding Post Issue 426,501,002 | Listing At BSE, NSE |

| Offer For Sale 63,492,063 Shares of ₹10 (Aggregating up to ₹2,000.00 Cr) | Face value ₹10 |

IPO Dates

| Offer Starts | 08 May 2024 |

| Offer Ends | 10 May 2024 |

| Allotment | 13 May 2024 |

| Refunds | 14 May 2024 |

| Credit of shares to Demat account | 14 May 2024 |

| IPO Listing | 15 May 2024 |

About Aadhar Housing Finance Limited

Incorporated in 2010, Aadhar Housing Finance Limited is a housing finance company targeting the lower income segment.

They have made social objectives one of the core objectives of their business model. They operate a financially inclusive, customer-centric lending business and believe that their business model contributes significantly to the economic uplift of their target customers by contributing to an improvement in their standard of living. In addition to their customer-facing social objectives, they have also implemented social objectives in aspects of their business. Their presence in urban and semi-urban locations across India provides a source of employment in these locations.

They have an extensive network of 471 branches* including 91 sales offices, as of September 30, 2023. Their branches and sales offices are spread across 20 states and union territories, operating in approximately 10,926 pin codes across India, as of September 30, 2023.

| Incorporated in | Managing Director |

| 2010 |

Aadhar Housing Finance Limited IPO Prospectus

| . | |

| DRHP Draft Prospectus | Click Here |

| RHP Draft Prospectus | Click Here |

Aadhar Housing Finance Limited IPO Lot Size

Aadhar Housing Finance Limited IPO minimum market lot is 47 shares with ₹14,805 application amount. The retail investors can apply up-to 13 lots with 611 shares or ₹192,465 amount.

| Application | Lots | Shares | Amount |

| Retail (Min) | 1 | 47 | ₹14,805 |

| Retail (Max) | 13 | 611 | ₹192,465 |

| S-HNI (Min) | 14 | 658 | ₹207,270 |

| S-HNI (Max) | 67 | 3,149 | ₹991,935 |

| B-HNI (Min) | 68 | 3,196 | ₹1,006,740 |

Share Holding

BCP Topco VII Pte. Ltd. is the promoter of the Company.

| Share Holding Pre-Issue | 98.72% |

| Share Holding Post-Issue |

Financials

| Year | 2023 | 2022 | 2021 |

| Revenue | ₹2,043.52 | ₹1,728.56 | ₹1,575.55 |

| Assets | ₹16,617.87 | ₹14,375.81 | ₹13,630.33 |

| Profit | ₹545.34 | ₹446.20 | ₹340.46 |

| All values are in Rs. Cr |

Fundamentals

| Values | Values | ||

| Market cap | 13434.78Cr | ROE | 18.04% |

| P/E (X) | 22.8 | ROCE | % |

| POST P/E (X) | 18.39 | EPS | 13.81 |

| Debt to Equity | 3.1 | RONW | 12.9% |

Objects of the Issue

- To meet future capital requirements towards onward lending

- General corporate purposes.

Brokerage Firm IPO Review

- To be updated soon

| Aadhar Housing Finance Limited Contact Details | |

| Address | Aadhar Housing Finance Limited Unit No. 802, 8th Floor, Natraj by Rustomjee, Junction of Western Express Highway and M. V. Road, Andheri (East), Mumbai 400 069, Maharashtra |

| Phone: | +91 22 3950 9900 |

| complianceofficer@aadharhousing.com | |

| Website | www.aadharhousing.com |

| Aadhar Housing Finance Limited IPO Lead Managers |

| ICICI Securities Limited Citigroup Global Markets India Private Limited Kotak Mahindra Capital Company Limited Nomura Financial Advisory and Securities (India) Private Limited SBI Capital Markets Limited |

| Aadhar Housing Finance Limited IPO Registrar | |

| . | KFin Technologies Pvt. Ltd |

| Phone | +91 40 6716 2222 |

| ahfl.ipo@kfintech.com | |

| Website | www.kfintech.com |

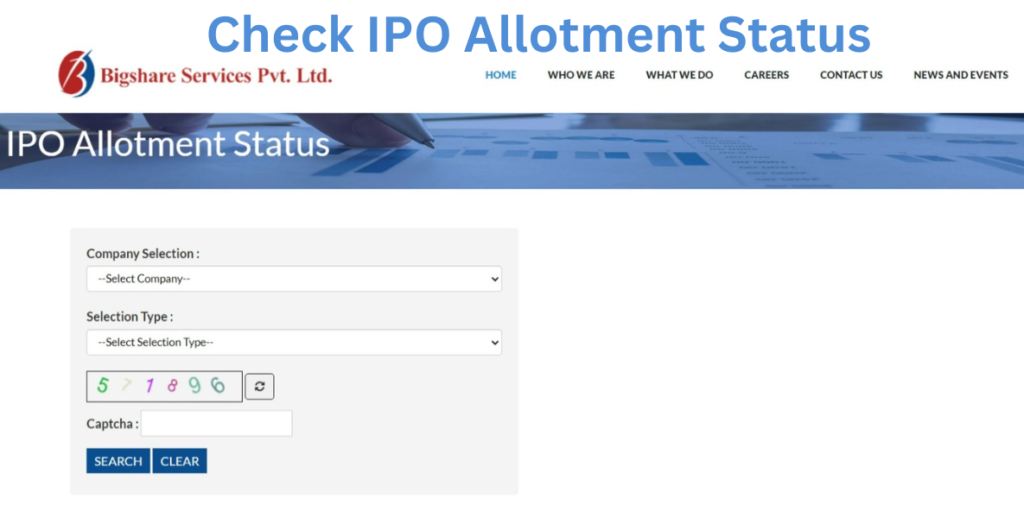

| Aadhar Housing Finance Limited IPO Allotment Status Check |

| IPO Allotment Status Check Click Here |

Aadhar Housing Finance Limited IPO FAQs

What is Aadhar Housing Finance Limited IPO?

- Aadhar Housing Finance Limited IPO is a MAIN BOARD IPO. They are going to raise ₹3,000.00Crores via IPO. The issue is priced at ₹300 to ₹315 per equity share. The IPO is to be listed on NSE, BSE

Aadhar Housing Finance Limited IPO will open?

- The IPO is to open on May 08, 2024, for QIB, NII, and Retail Investors.

What is Aadhar Housing Finance Limited IPO Investors Portion?

- The investors’ portion for QIB is 50%, NII is 15%, and Retail is 35%.

What is Aadhar Housing Finance Limited IPO Size?

- Aadhar Housing Finance Limited IPO size is ₹3,000.00 crores.

What is Aadhar Housing Finance Limited IPO Price Band?

- Aadhar Housing Finance Limited IPO Price Band is ₹300 To ₹315 per equity share.

What is Aadhar Housing Finance Limited IPO Minimum and Maximum Lot Size?

- The IPO bid is Minimum 1-Lot (47 Shares) with ₹14,805 and Maximum Lot Size 13-Lots (611 Shares) with ₹192,465

What is TAadhar Housing Finance Limited IPO Allotment Date?

- Aadhar Housing Finance Limited IPO allotment date is May 13, 2024.

What is Aadhar Housing Finance Limited IPO Listing Date?

- Aadhar Housing Finance Limited IPO listing date is May 15, 2024. The IPO to list on NSE, BSE.