Varyaa Creations Limited IPO is an BSE SME IPO. They are going to raise ₹20.10 Crores via IPO. The issue is priced at ₹150 to ₹150 per equity share. The IPO is to be listed on BSE.

IPO opens for subscription on April 22, 2024, and closes on April 25, 2024. The allotment for the Varyaa Creations Limited IPO is expected to be finalized on April 26, 2024. Varyaa Creations Limited IPO will list on BSE SME with tentative listing date fixed as April 30, 2024.

| IPO Details | allotment |

| Minimum Investment ₹150,000 /1 Lot (1000 shares) | Price Range ₹150-₹150 | |

| Max Quantity 1 Lots/1000 Shares | Max Investment ₹150,000 | Retail Discount ₹0 |

| Investor category and subcategory Individual- HNI & Retail | Issue Size 20.10 Cr | Employee Discount ₹0 |

| Total Issue Size 1,340,000 Shares (aggregating up to ₹20.10 Cr) | Share Holding Pree Issue 3,450,000 | Issue Type Fixed Price Issue IPO |

| Fresh Issue Share 1,340,000 Shares (aggregating up to ₹20.10 Cr) | Share Holding Post Issue 4,790,000 | Listing At BSE SME |

| Market Maker Portion 70,000 Shares (Svcm Securities) | Face value ₹10 pr share. |

IPO Dates

| Offer Starts | 22 April 2024 |

| Offer Ends | 25 April 2024 |

| Allotment | 26 April 2024 |

| Refunds | 29 April 2024 |

| Credit of shares to Demat account | 29 April 2024 |

| IPO Listing | 30 April 2024 |

About Varyaa Creations Limited

Incorporated in July 2005, Varyaa Creations Limited deals in wholesale trading of gold, silver, precious stones, and semi-precious stones.

| Founded in | Managing Director |

| 2008 | Mr. |

Share Holding

The promoters of the Company are Mrs. Pooja Vineet Naheta and Mrs. Sarika Amit Naheta

| Share Holding Pre-Issue | 100.00% |

| Share Holding Post-Issue | 72.02% |

Varyaa Creations Limited IPO Prospectus

| Varyaa Creations Limited IPO Prospectus | |

| DRHP Draft Prospectus | Click Here |

| RHP Draft Prospectus | Click Here |

Financials

| Year | 2023 | 2022 | 2021 |

| Revenue | ₹538.03 | ₹253.13 | ₹12.05 |

| Assets | ₹2,000.55 | ₹143.78 | ₹218.32 |

| Profit | ₹78.93 | ₹57.98 | -₹13.06 |

| values are in ₹. Lakhs |

Fundamentals

Company’s key performance indicators

| Values | Values | ||

| Market cap | 71.85 Cr | ROE | 85.52% |

| P/E (X) | 65.56 | ROCE | 114.57% |

| POST P/E (X) | 10.23 | EPS | 2.29 |

| Debt to Equity | RONW | 85.52% |

Objects of the Issue

The Objects of the company is to raise funds for:

- To finance the establishment of new showroom a) Capital expenditure cost for the proposed new showroom and Purchase of Inventory for the proposed new showroom. b) Purchase of Inventory

- General Corporate Purpose

- To meet the expenses of the Issue

Brokerage Firm IPO Review

- To be updated soon

| Varyaa Creations Limited Contact Details | |

| Address | Varyaa Creations Limited 11, Floor-3rd, Plot 5/1721, Kailash Darshan, Jagannath Shankarseth Marg-Kennedy Bridge, Gamdevi, Grant Road, Mumbai-400007 |

| Phone: | +91 9920558483 |

| info@varyaacreations.com | |

| Website | https://varyaacreations.com/ |

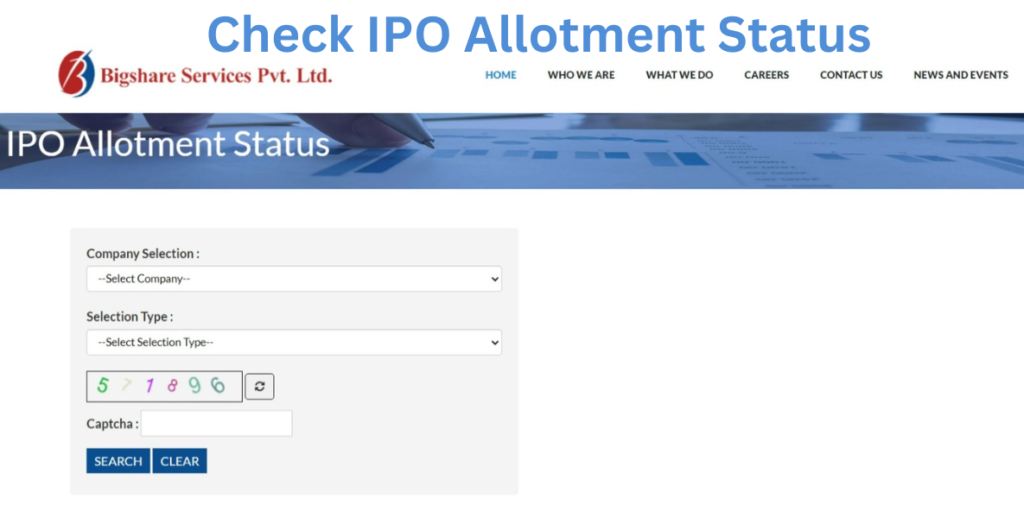

IPO Registrar | |

| . | Bigshare Services Pvt Ltd |

| Phone | +91-22-6263 8200 |

| ipo@bigshareonline.com | |

| Website | http://www.bigshareonline.com |

| Varyaa Creations Limited IPO Allotment Status Check |

| Varyaa Creations Limited IPO Allotment Status Check Click Here |

| Varyaa Creations Limited Lead Managers | |

| Inventure Merchant Banker Services Pvt Ltd 2nd Floor, Viraj Tower, Western Express Highway, Andheri (East) Mumbai – 400 069 | |

| Phone | +91 22 4075 1515 |

| bronze.smeipo@inventuremerchantbanker.com | |

| Website | http://www.inventuregrowth.com |

Grill Splendour Services Limited IPO FAQs

What is Varyaa Creations Limited IPO?

- Varyaa Creations Limited IPO is an BSE SME IPO. They are going to raise ₹20.10 Crores via IPO. The issue is priced at ₹150 to ₹150 per equity share. The IPO is to be listed on BSE.

- The IPO opens on April 22, 2024, and closes on April 25, 2024.

When Varyaa Creations Limited IPO will open?

- The IPO is to open on April 22, 2024, for NII, and Retail Investors. and closes on April 25, 2024

What is Varyaa Creations Limited IPO Investors Portion?

- The investors’ portion for NII is 50%, and Retail is 50%.

What is Varyaa Creations Limited IPO Size?

- Varyaa Creations Limited IPO size is ₹20.10 crores.

What is Varyaa Creations Limited IPO Price Band?

- Varyaa Creations Limited IPO Price Band is ₹150 to ₹150 per equity share.

What is Varyaa Creations Limited IPO Minimum and Maximum Lot Size?

- The IPO bid is Minimum 1 Lot (1000 Shares) with ₹150,000. and Maximum Lot Size 1 Lots (1000 Shares) with ₹150,000

What is Varyaa Creations Limited IPO Allotment Date?

- Varyaa Creations Limited IPO allotment date is April 26, 2024.

What is Varyaa Creations Limited IPO Listing Date?

- Varyaa Creations Limited IPO listing date is April 30, 2024. The IPO to list on BSE.